- Experience the best pos software today

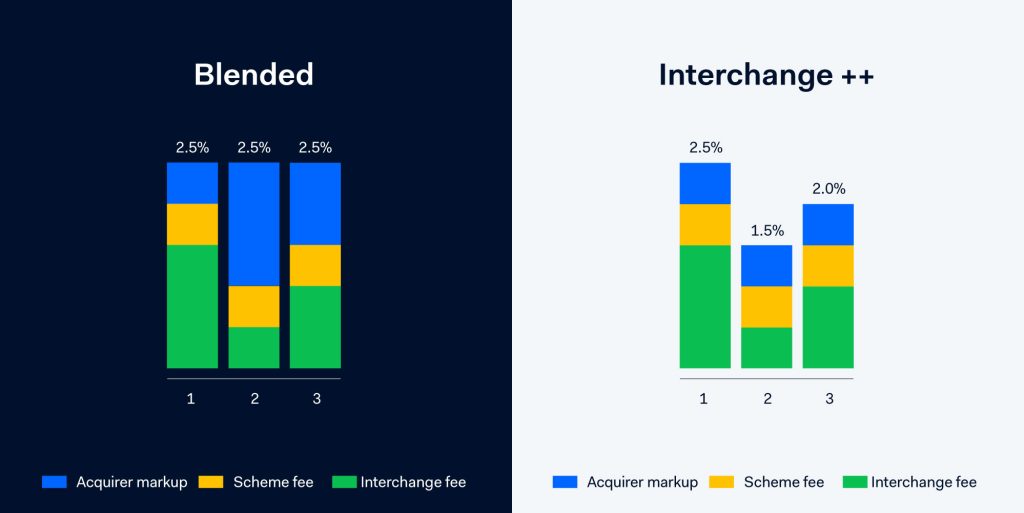

The two leading pricing models are the flat rate (blended) and the interchange-plus (cost+). What exactly are these, and why should business owners care?

Every credit card operation involves a charge, known as Interchange (or Cost-Plus Pricing), determined by Visa/Mastercard. Visa/Mastercard levies interchange reimbursement charges, which are the transfer costs between the merchant (or acquiring bank) and the card-issuing bank for each Visa card operation. Visa/Mastercard is quite open about these charges and lists them online, taking into account various aspects like the card category (be it personal or business), and whether the card is present during the transaction (for instance, online purchases are card-not-present transactions). Often referred to as Interchange Fees, they can be intricate since they depend on the card’s nature, transaction method, item acquired, among other things. Interchange is distinct from the processor’s charge, which is an additional fee for every transaction.

With flat rate services, businesses are charged a steady percentage for each credit card sale. This rate needs to be set so it covers varying card company fees and leaves a bit for the company processing the payment. This method is straightforward since the fees are predictable. But, the shop owner often doesn’t know how much they’re really paying versus how much the processing company is making. And for shops selling low-priced items to regular folks (B2C), this can really eat into their profits.

Flat rate methods are popular among new businesses because they’re easy to get started with. Companies like Paypal, Square, and Stripe use this system and don’t need businesses to have a special seller account. Some newer or smaller businesses can’t qualify for these special accounts, so they opt for these easy-to-use systems.

Even businesses that can get special seller accounts might choose flat rate because it’s straightforward and costs remain steady.

Sadly, many companies don’t clearly explain how card payments work, more then often leading to businesses paying more than they should.

With Interchange Plus, the business pays the Interchange fee specific for each transaction type, plus a pre-negotiated margin for the processor. While flat rate may seem more straightforward, Interchange Plus is actually much more transparent: the business owner can see the exact Interchange cost for each transaction.

The Interchange Plus model can also save a merchant money. For example, the cost difference of a debit card transaction flat rate vs Interchange Plus is dramatic. Debit transactions are lower risk because funds are taken directly from a checking account. As a result, the Interchange rate is typically below 1%. Given that a common flat rate is 2.9%, merchants give away a significant amount of their profit to the payment processor on each flat rate debit card transaction.

Interchange Plus is ideal for established businesses that qualify for a merchant account. The underwriting process does take time (2-3 days), but it can be worth the wait. Benefits are not only in the potential cost savings, but also the flexibility and improved customer service that can accompany the right merchant account. An experienced payment processor, like JP morgan Chase, can break down the numbers and show you the savings.

Numbers Don’t Lie – Flat Rate vs. Interchange Plus

2.9%+ .30/transaction is a pretty standard rate for flat rate payment services company. But let’s see what this looks like if a business owner sells $25 t-shirts and the customer pays by a debit card. Let’s see what that looks like per customer and what it looks like if you had 100 customers buy a t-shirt:

ABC T-Shirt Company

Common Flat Rate : 2.90% + .30/transaction

1 customer/ 1 t-shirt @ $25.00 = .725 + .30 = $1.025

100 customers / 100 t-shirts @ $25.00 = $1.025 x 100 = $102.50

Sales less Processing Fees : $2500 – $102.50 = $2397.00

Effective Rate % = 4.1%. The merchant is actually paying 4.1%.

Card Not Present/ e-Commerce Basic: 1.65% (interchange rate per Visa) PLUS let’s say 25 basis points (for example only) + .10/transaction:

1 customer/ 1 t-shirt @ $25.00 = .4125 + .0625 + .10 = .575

100 customers / 100 t-shirts @ $25.00 = .575 x 100 = $57.50

Sales less Processing Fees : $2500 – $57.50 = $2442.50

Effective Rate % = 2.3%

This is a savings of $45.00 for 100 t-shirts for 100 customers or a reduction of 1.8% in processing fees. If our t-shirt company processes 100 orders per day, 1 t-shirt per order, every day for a month (30 days), that is a savings of $1,350.00 a month or $16,200.00 in a year.

Think about it. What can you do with the money you can save? Increase your ad spend. Improve your website. Have a few pizza parties in the office. Increase profit sharing to your hard-working employees. Using money that would have otherwise been paid in excess to a flat rate payment services provider could be used to improve products, improve your website’s UX, reduce employee churn, build your brand, and help you create the company your entrepreneurial dreams are made of.

Physical storefronts are opening up again and many retailers are updating their point-of-sale (POS) terminals not only to contactless solutions in order to keep their customers and staff healthy, but the new terminals also have EMV. EMV is an acronym for “Europay, Mastercard and Visa”. This is for added security to use the microchip that is now on most credit cards to reduce fraud. Not only is it important to reduce ecommerce fraud, but also card present fraud to reduce inventory and revenue loss. With an increased number of credit cards that have an EMV chip and ever changing card technologies, it is important for stores to have EMV compliant terminals. Flat rate payment services companies have many different EMV compliant terminals to choose from, however, you still have flat fee rates to pay that are usually the same as your card-not-present (ie. ecommerce). Card Present fees using Interchange are significantly less than flat rate services.

For example, our ABC T-Shirt Company.

ABC T-Shirt Company

Common Flat Rate: 2.90% + .30/transaction

1 customer/ 1 t-shirt @ $25.00 = .725 + .30 = $1.025

100 customers / 100 t-shirts @ $25.00 = $1.025 x 100 = $102.50

Sales less Processing Fees: $2500 – $102.50 = $2397.00

Effective Rate % = 4.1%. The merchant is actually paying 4.1%.

Card Present/ Brick and Mortar Store: .80% (interchange rate per Visa) PLUS let’s say 25 basis points (for example only) + .15/transaction:

1 customer/ 1 t-shirt @ $25.00 = .20 + .0625 + .15 = .4125

100 customers / 100 t-shirts @ $25.00 = .4125 x 100 = $41.25

Sales less Processing Fees: $2500 – $41.25 = $2499.59

Effective Rate % = 1.65%

This is a savings of $61.50 for 100 t-shirts for 100 customers or a reduction of 2.45% in processing fees. That is, you are cutting the processing fees by over half. If ABC T-Shirt Company processes 100 brick-and-mortar store orders per day, 1 t-shirt per order, every day for a month (30 days), that is a savings of $1,845.00 a month or $22,140 in a year. These savings can literally be the cost of an employee.

If you have flat rate merchant services, now may be the time to switch. Do you have 12 months of processing history? Do you generate more than $50,000 in processing annually? Do you have a lot, or very few, chargebacks? There are many merchant account services agencies, or ISOs (Independent Sales Organizations) that have bank relationships as well as banks that can help you determine if your business would qualify. Keep in mind that if you’re current Point-of-sale (POS) solution forces you to use its own flat rate processing, Solvr Can Guarantee you entry into the Interchange Plus model.

There are many factors to consider when choosing a merchant account services provider but at the end of the day, the money you save and the more personal customer service will be well worth the switch.